In the ever-expanding urban landscape of Phoenix, AZ, where the cost of living is as varied as its sprawling desert vistas, managing personal finances efficiently is more crucial than ever. Residents of Phoenix, from young professionals embarking on their career journeys to retirees enjoying the sunny leisure of their golden years, face unique financial challenges and opportunities. At Fit Financial Coaching, situated in the heart of Phoenix, we recognize the importance of robust financial tools that can assist in navigating this diverse economic environment. Budgeting apps play a pivotal role in this process, offering accessibility and convenience to manage your finances smartly and effectively.

In this blog post, we delve into the top 5 budgeting apps that are perfect for Phoenix residents looking to take control of their finances. Whether you’re planning for your next big adventure in the Grand Canyon or saving for a comfortable retirement under the Phoenix sun, these apps provide the features you need to set budgets, track spending, and achieve your financial goals. Each app has been selected based on its ease of use, effectiveness, and compatibility with the financial needs of those living in Phoenix. From apps that link directly with your bank accounts for real-time spending updates to those offering customizable budgeting categories suited to your lifestyle, these tools are designed to help you maintain financial health in a city known for its dynamic economy.

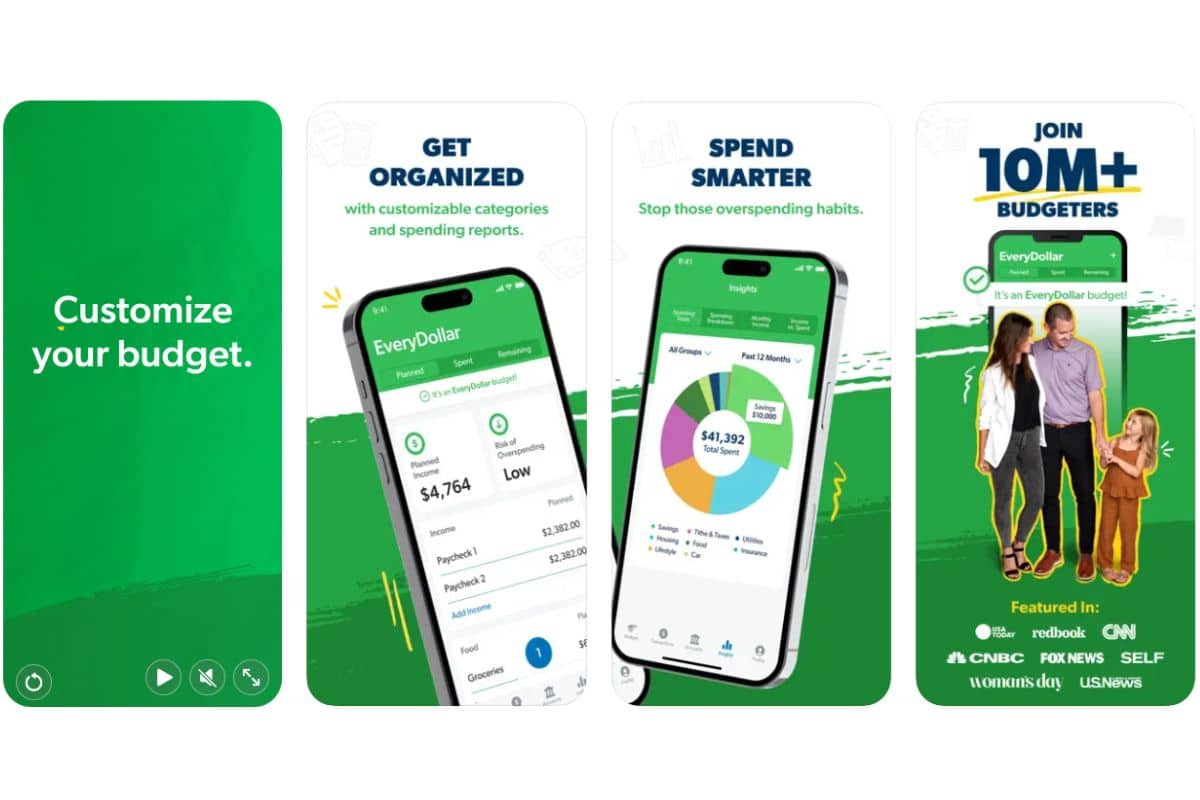

#5 EveryDollar

EveryDollar is a budgeting tool that applies the zero-based budgeting system, a method highly effective for those looking to gain complete control over their finances, including residents of Phoenix, AZ. This method ensures every dollar you earn is assigned a specific purpose, whether it’s spending, saving, or investing, leaving no money “unassigned” by the end of the month. This meticulous approach is particularly beneficial in Phoenix, where managing finances against the backdrop of a fluctuating economy requires diligent planning. EveryDollar simplifies this process, allowing users to create customized monthly budgets that can adapt to seasonal expenses like higher summer cooling bills or holiday shopping spikes.

The app’s straightforward interface facilitates quick budget setup, where Phoenix users can input their monthly income, list their expenses, and assign remaining funds to savings or debt repayment. This hands-on approach not only fosters a deeper understanding of personal cash flows but also encourages a disciplined spending habit. For many in Phoenix, especially those working toward significant financial goals like home ownership in one of the city’s burgeoning neighborhoods or saving for retirement, EveryDollar provides a clear path to achieving those objectives. The app’s focus on proactive budget management helps users avoid the common pitfall of reactive spending, which often leads to debt accumulation.

Additionally, EveryDollar offers both free and premium versions, the latter of which links directly to your bank accounts for automatic transaction updates, further simplifying the budgeting process. This feature can be particularly valuable for Phoenix residents who balance multiple income sources or who have dynamic spending needs that vary significantly from month to month. The premium version also provides additional insights and detailed reports that can help users analyze spending trends and adjust their budgets more effectively. By employing EveryDollar, Phoenix residents can ensure that every cent of their income is being utilized efficiently, aligning their financial actions closely with their personal and financial aspirations.

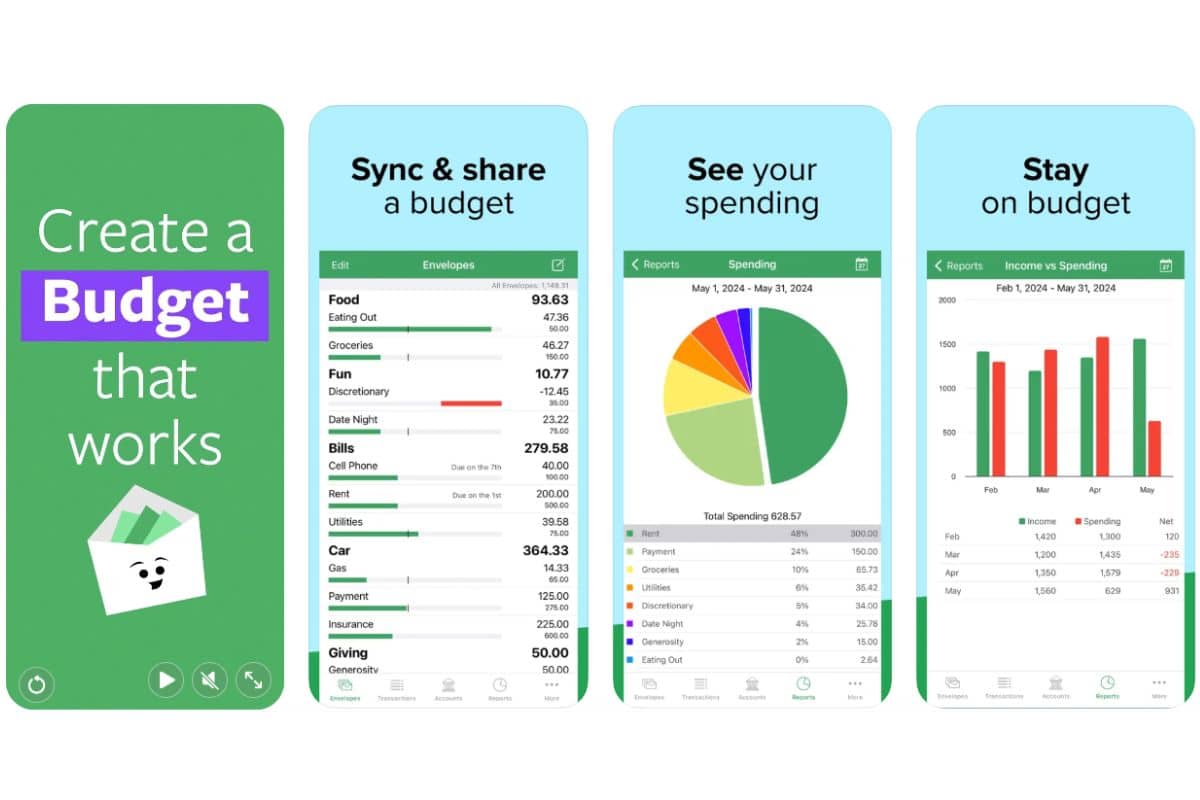

#4 GoodBudget

GoodBudget revitalizes the classic envelope budgeting system for the digital age, making it an excellent choice for Phoenix residents who prefer a hands-on approach to managing their finances. This app allows users to allocate their income to various spending categories, or “envelopes,” which helps in planning and controlling expenditures for different aspects of their lives. For example, one might have envelopes for groceries, monthly bills, dining out, and entertainment — categories that can vary significantly in a city like Phoenix where options are plentiful and diverse. By dividing money into these envelopes at the start of each budgeting period, users can prevent overspending in any one category.

This app is particularly useful for families or couples in Phoenix who need to manage a shared budget. GoodBudget offers the ability to sync across multiple devices, ensuring all parties are informed and engaged with their joint financial plans. This feature promotes transparency and accountability within households, helping to maintain a cohesive financial strategy. Whether it’s saving for a family outing to one of Phoenix’s many cultural festivals or managing everyday expenses, GoodBudget helps users stick to their financial goals by providing a clear, visual representation of where their money is going.

Additionally, GoodBudget doesn’t require a direct link to your bank account, which can be a significant advantage for those who prefer not to share their bank details or who enjoy manual control over entry of their transactions. This can enhance security and gives users complete control over what transactions are recorded and how they are categorized, which can be particularly appealing for Phoenix residents who value privacy and hands-on financial management. With its easy-to-use interface and effective budgeting framework, GoodBudget helps Phoenix users navigate their financial landscape, ensuring they make the most of their income without falling into debt.

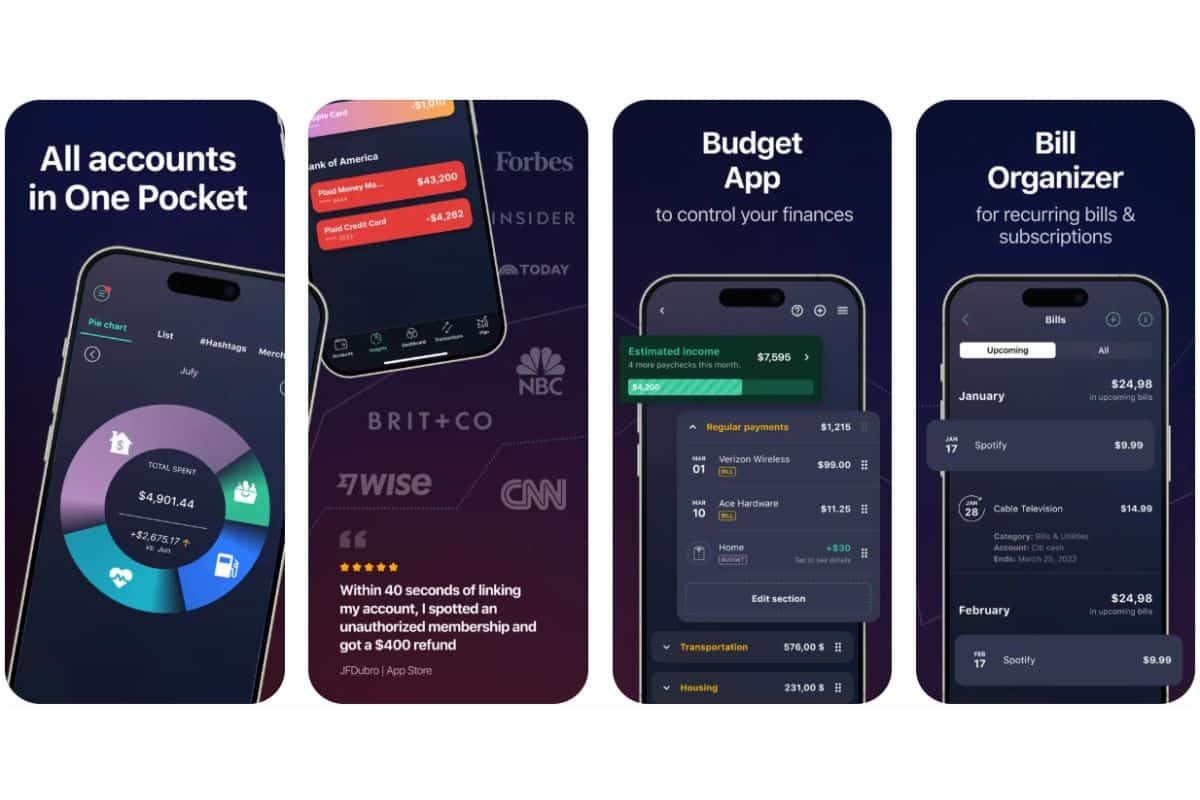

#3 PocketGuard

PocketGuard stands out as a budgeting app designed to help Phoenix, AZ residents simplify their spending by providing a clear picture of how much disposable income they have at any given time. This feature is particularly useful in a city like Phoenix, where diverse entertainment and dining options can tempt even the most frugal spender. PocketGuard links directly to all your financial accounts, automatically categorizing transactions and updating your spending balances, which allows users to see their remaining spendable money after accounting for bills, savings goals, and essentials. This real-time overview helps prevent overspending and encourages more thoughtful financial decisions.

The app’s ability to identify recurring payments and suggest optimizations is another feature that benefits Phoenix residents. By analyzing monthly subscriptions and bills, PocketGuard can pinpoint areas where users might be overspending, such as on streaming services or gym memberships that aren’t being utilized. The app not only highlights these costs but also provides tools for lowering bills, such as negotiating better rates or identifying cheaper alternatives, which is ideal for those in Phoenix looking to streamline their budgets without sacrificing their lifestyle quality.

Furthermore, PocketGuard sets itself apart with the “In My Pocket” feature, which forecasts future spending, income, and savings. For Phoenix dwellers, where fluctuating temperatures can lead to unpredictable utility bills, having a forecast that adjusts based on actual spending and income can be incredibly valuable. It allows users to adjust their budgets in response to higher-than-expected air conditioning costs in summer months or to allocate extra funds to savings during cooler times of the year when energy costs might dip. Overall, PocketGuard provides a user-friendly platform for managing personal finances that is both adaptive and proactive, fitting well with the dynamic financial needs of Phoenix residents.

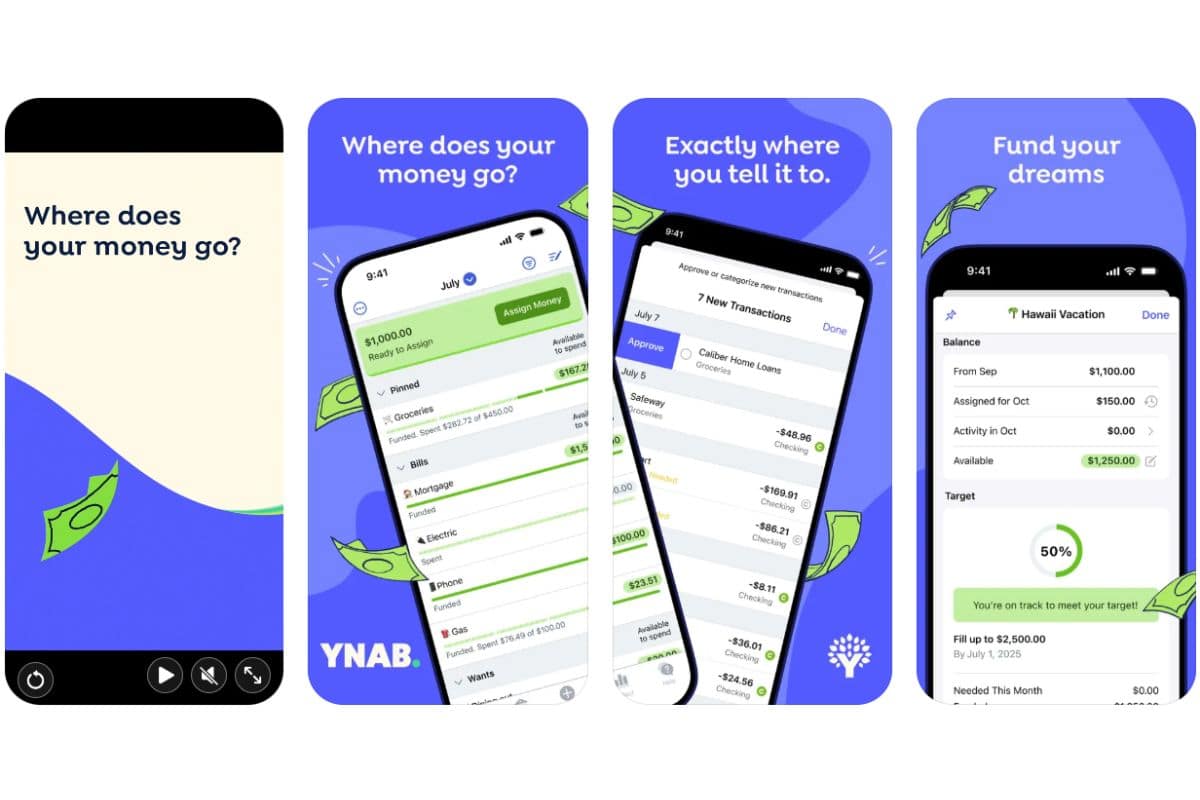

#2 You Need a Budget

YNAB (You Need A Budget) is another powerful tool for those serious about managing their finances, particularly effective for Phoenix, AZ residents due to its proactive approach to budgeting. Unlike apps that merely track spending, YNAB is built around a philosophy that encourages users to “give every dollar a job.” This methodology promotes a proactive stance on budgeting, requiring users to assign each dollar of their income toward specific expenses, savings, or debt payments. This approach is particularly useful in Phoenix, where varying income levels, from those in the gig economy to full-time employees, can benefit from a system that ensures every dollar is purposefully spent or saved.

YNAB also excels in helping users plan for larger, less frequent expenses, which can often derail financial stability if not anticipated. For residents in Phoenix, this could include planning for annual property taxes, saving for the higher utility bills in the summer, or budgeting for yearly family trips. YNAB encourages setting aside small amounts each month for these larger expenses, smoothing out financial spikes throughout the year. This can prevent Phoenix residents from resorting to credit cards or loans when big bills come due, thus avoiding additional debt.

The app also offers robust educational resources that help users understand the fundamentals of budgeting and financial planning. YNAB provides online classes, blogs, and video tutorials that cover a wide range of topics from basic budgeting to complex financial planning. These resources are especially useful in Phoenix, where economic diversity and opportunities make financial literacy a crucial skill for achieving long-term financial peace. By educating its users and encouraging a thoughtful, proactive approach to money management, YNAB not only helps Phoenix residents manage their current financial situation but also prepares them for future financial success.

#1 Mint

Mint has consistently ranked as one of the most comprehensive and user-friendly budgeting apps available, making it an ideal choice for residents of Phoenix, AZ looking to manage their finances with precision. The app’s ability to aggregate all financial information — from bank accounts and credit cards to loans and investments — into a single dashboard offers a clear overview of your financial health at a glance. This feature is particularly beneficial in Phoenix, where managing various expenses from cooling bills during the sweltering summer months to leisure spending on the city’s numerous entertainment options can be cumbersome. Mint automates expense tracking by categorizing each transaction, which simplifies the task of adhering to a budget and identifying areas where spending can be reduced.

Furthermore, Mint provides real-time updates and personalized insights based on your spending habits, alerting you when you’re approaching budget limits or when unusual transactions occur. This instant feedback is crucial for Phoenix residents who need to make quick adjustments to their spending, especially during months when utility costs can spike unexpectedly. The app also offers financial goal-setting tools that can be customized for a variety of objectives, whether it’s saving for a down payment on a house in one of Phoenix’s up-and-coming neighborhoods or setting aside money for a well-deserved vacation.

Additionally, Mint’s free credit score monitoring is an excellent resource for anyone looking to improve or maintain their credit health, a key aspect of financial stability. This feature allows Phoenix users to stay informed about their credit status without having to pay for a separate service, making Mint not just a budgeting tool but a comprehensive financial management app. Its intuitive design and proactive budgeting assistance empower users to take control of their finances and make informed decisions that align with their personal and financial aspirations in Phoenix.

For residents of Phoenix, AZ, choosing the right budgeting app can transform the daunting task of financial management into a streamlined, effective process. Each of the five apps discussed—Mint, YNAB, PocketGuard, GoodBudget, and EveryDollar—offers unique features that cater to different budgeting needs and preferences. Whether you prefer the comprehensive financial oversight provided by Mint, the proactive budget planning of YNAB, the simplicity of PocketGuard, the envelope system of GoodBudget, or the precision of zero-based budgeting with EveryDollar, there is a tool that can help you achieve your financial goals.

In Phoenix, where the landscape is as varied as the financial situations of its residents, utilizing these tools can provide clarity, control, and confidence in managing personal finances. As you navigate through the vibrant city life, from exploring its natural desert beauty to indulging in its rich cultural offerings, having a solid grasp on your finances is essential. These budgeting apps not only help prevent debt but also empower you to save effectively, invest wisely, and spend enjoyably, enhancing your quality of life in Phoenix.

At Fit Financial Coaching in Phoenix, we are dedicated to helping you integrate the most effective financial tools into your lifestyle. We understand that financial success is best achieved with tailored solutions that fit your unique circumstances and goals. By leveraging these top budgeting apps, together with personalized advice and strategic planning from our experts, you’re well on your way to securing a financially stable and prosperous future in the heart of Arizona. Remember, managing your money wisely is not just about securing your future but also about enjoying your present in Phoenix, AZ.